Whether you drive a single truck or oversee an entire fleet, trucking is a business that comes with many risks. Fortunately, there are several different types of truck insurance that can help protect everything you’ve worked so hard for. The size of your fleet, types of vehicles you operate, and cargo you haul will determine your needs. At American Insurance Brokers, we provide a variety of commercial trucking insurance options. Our goal is to ensure you always have the coverage you need, no matter where the job takes you. Here’s what you need to know to get started.

Different Types of Truck Insurance We Offer

What Types Of Vehicles Need Commercial Trucking Insurance?

The experts at American Insurance Brokers can help you find a policy for practically any type of truck on the road. From tow trucks to car carriers, our team members have years of experience finding the right insurance for Southern trucking companies. Whether you’re an independent driver or operating a business, we can secure the right policy.

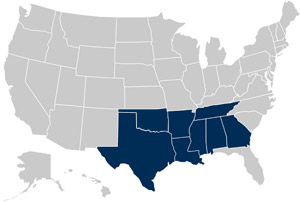

We provide commercial trucking insurance for drivers in Texas, Louisiana, Arkansas, Mississippi, Alabama, Georgia, and Tennessee. Traveling across state lines? That’s not a problem. We’ll make sure you have the coverage you need every time you hit the road.

Here are some of the types of vehicles we help cover:

- Box trucks

- Tractor-trailers

- Car carriers

- Dump trucks

- Flatbed trucks

- Hotshot trucks

- Moving trucks

- Semi-trucks

- Straight trucks

- Tank trucks

- Tow trucks

If you don’t see your type of vehicle on this list, just give us a call. With so many types of truck insurance, we’re able to accommodate nearly any request. Our knowledgeable team can connect you with the right policy at the right price.

Types of Truck Insurance We Offer

With so many commercial vehicles on the road, it makes sense that there are many different types of truck insurance. If you’re searching for basic coverage, you’ll want to ensure you have a policy that protects you in various incidents, from accidents to vandalism to weather events. Likewise, you need insurance for the cost of damages and injuries caused by an accident that is your fault.

Let’s dive into the different types of truck insurance we connect you with at American Insurance Brokers.

Commercial auto liability

In the event of an accident that is your fault, this type of policy may cover the injuries and property damage of other people. It may also cover your legal costs in the case of a lawsuit.

Physical damage

This is a general term for coverage that protects your truck. This may include collision insurance, as well as full comprehensive insurance or fire and theft with combined additional coverage (CAC).

Collision insurance may provide coverage for repairs or a replacement if your vehicle collides with an object, rolls, or overturns.

Comprehensive coverage is for damage due to something other than a collision (or if your vehicle is stolen). Fire and theft with CAC is similar but has limitations when it comes to non-collision incidents.

Medical payments

Medical payments coverage, also known as MedPay, may provide coverage for medical expenses after an accident. Regardless of who caused the accident, this is coverage that kicks in if you and/or your passengers are injured.

Uninsured motorist

The prospect of getting into an accident with someone who is uninsured can be frightening. This is one of the types of truck insurance that can help you in this type of event. It also provides coverage if the other party is underinsured.

Trailer interchange

Designed for trailers pulled under a trailer interchange agreement, this coverage may protect your trailer if it’s damaged by collision, fire, theft, explosion, or vandalism.

Non-trucking liability

There are cases when you may use your truck for personal use such as grocery shopping or other errands. This is when non-trucking liability is important to have because it provides coverage for accidents that happen under these circumstances.

This is often confused with bobtail insurance, but they are not the same. What is bobtail insurance? It covers you and your truck after you’ve dropped off a trailer or load. For example, it covers you during the time period after you drop off a trailer and are headed to the next location for a pick-up.

Motor truck cargo

When for-hire truckers are hauling items, that cargo needs coverage. Regardless of what the cargo is, motor truck cargo insurance may provide coverage if those items are lost or damaged due to fire or a collision.

Motor truck general liability

For blanket coverage in situations unrelated to truck operations, motor truck general liability is essential. This may be for injuries, property damage, and other circumstances. Here are a few examples:

- Libel and slander

- Incorrect delivery of cargo that results in damage

- Actions of a driver while on the premises of a loading dock, truck stop, etc.

On-hook towing

Tow trucks have a unique job that involves certain risks. Because they’re frequently hauling vehicles, it’s important to have on-hook towing insurance. This may provide the money necessary to repair or replace a vehicle that is damaged during towing.

Whether towing is required due to a collision, fire, or even vandalism, this type of insurance will provide protection for your business.

Garagekeepers’ legal liability

Business owners who offer service stations and towing services often have customer vehicles under their care. Garagekeepers’ legal liability can protect business owners in the event that a customer’s vehicle is damaged or stolen during these times.

Workers’ compensation

Also known as workers’ comp, this is one of the mandatory types of insurance for many businesses. The purpose is to cover medical costs and a portion of lost wages for employees who are injured while on the job. It may also protect companies from workplace condition lawsuits.

What Is The Average Commercial Truck Insurance Cost?

If you’re wondering about the average commercial truck insurance cost, the answer is tricky. There are many different factors that go into determining your monthly premium.

Here are some of the factors that will impact how much you pay:

- Cargo: For trucks hauling cargo, the type of cargo is an important factor. This is because some items are more dangerous to transport. For example, a car carrier with a dozen vehicles will probably cost more to insure than a truck hauling produce. In the event of an accident, the car carrier will likely cause more damage. Hauling hazardous materials is another important distinction that can make your policy cost more.

- Vehicle type: Insurance for trucking companies will depend on the type of vehicle being insured. A large semi-truck can do more damage than a tow truck, which is why it will usually cost more to insure. Plus, newer vehicles are typically more expensive to insure because they cost more to repair or replace in the event of an incident.

- Route: Trucks operating within a larger radius are usually exposed to more risks. Longer routes can mean longer hours and potentially unfamiliar highways. A truck with a small and consistent route will typically pay less for different types of truck insurance.

- Location: Likewise, insurance rates vary by state. Some geographic areas will simply cost more due to increased traffic, weather conditions, and other factors.

- Driving history: Just like a personal auto insurance policy, driving history is another large factor when it comes to cost. Accidents and traffic violations will raise your premium because of the potential impact of an incident with a large truck. Maintaining a clean driving record could save you hundreds of dollars or more every month, depending on the size of your fleet.

At American Insurance Brokers, we work tirelessly to find the most competitive rates for our clients. We can put together a policy with different types of truck insurance that provide protection while staying within your budget.

Contact American Insurance Brokers Today

When you partner with American Insurance Brokers, you have decades of experience on your side. Because we’ve spent so many years serving Southern truck drivers, we know exactly what you’re up against. Our track record of reliability, as well as affordability, sets us apart from the competition.

The knowledgeable team members at American Insurance Brokers will walk you through every detail of your new policy. Have a question? Just ask! We always aim to provide the answers you need in a timely manner.

We Are Committed To Our Customers

Due to the ever-changing nature of the insurance industry, we conduct an annual review for all of our clients. This helps up confirm you’re getting the coverage you need at a fair price. We’re always looking for new ways to improve your coverage or commercial truck insurance cost.

Are you a new client? We’ll provide the same complimentary policy review. This thorough analysis allows us to take a closer look at your current coverage. We want to see low deductibles and high limits, giving you great protection at a great price. During this free policy review, our team will also check for compliance with federal and state filings.

Ready to discuss the types of truck insurance you need? Call American Insurance Brokers today!