What to Consider When Comparing Truck Insurance Companies

We get it. Sitting around looking for the best commercial truck insurance companies can feel overwhelming. What do you look for? Where do you even start?

At American Insurance Brokers, we do the leg work for you. Because we have relationships with many of the top providers in the industry, we already know which steps to take to find great coverage.

Whether you’re an independent driver or managing an entire fleet, we can match you with a policy that fits your exact needs. Here’s what we consider as we comb through the best truck insurance companies to find a perfect fit for each of our clients.

1. Coverage options that fit your needs

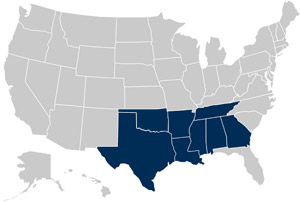

First and foremost, the best trucking insurance companies will be able to create a policy that fits your unique business. Trucking is an industry that varies greatly from place to place and vehicle to vehicle. The needs of a dump truck operator in Texas will not be the same as a semi-truck driver in Louisiana. With this in mind, it’s important to find the coverage that fits your daily challenges.

Examples of different types of insurance include:

- Liability Coverage: A company operating older trucks may prefer the cost-saving lower premiums of a liability-only policy. This typically covers just enough to operate legally. While this type of policy generally won’t cover the cost of repairing a truck, it would cover the costs of damage caused by the truck. There are multiple types of liability coverage available. The agents at American Insurance Brokers can determine which coverages best protect your business.

- Physical Damage Coverage: This type of coverage protects your interests if your truck is damaged or stolen. From collision insurance to comprehensive coverage for fire and theft, your truck is protected under this type of policy.

- Motor Truck Cargo Coverage: This type of coverage protects you in the event that the cargo your truck is hauling is damaged. Some shipping companies require this coverage before contracting with a carrier to deliver a load. Regardless of the type of cargo, this insurance may be beneficial if these items are lost or damaged due to fire or a collision.

- Uninsured/Underinsured Motorist Coverage: If an uninsured driver (or someone who is underinsured) hits your vehicle, this coverage protects your interests by covering the cost of repairs.

- Non-Trucking Liability: If you use your truck for personal use, such as grocery shopping or errands, non-trucking liability provides coverage for accidents that happen under these circumstances. If you spend long days (or even weeks) out on the road, this type of insurance is important to have.

It’s essential to keep in mind that this is not a complete list of insurance offerings. To learn even more about commercial truck insurance companies, read through the different types of coverage we can help you obtain.

2. High limits and low deductibles

At American Insurance Brokers, we spend a significant amount of time reviewing our clients’ policies. What’s more, we do this on an annual basis. When we conduct this type of review, we want to see that your current plan has appropriately low deductibles and high limits.

What does that mean? The amount you will have to pay before the insurance company makes any payment should be relatively low. On the other hand, when it comes to the absolute limit regarding what the insurance company will pay, the number should be considerably high. This is the best way to ensure you are protected in the event of a catastrophic accident.

3. Federal compliance

Federal and state requirements are tedious, yet necessary, especially in the trucking industry. There are many forms to keep track of, and regulations often change from year to year. They may include:

- FMCSA: A Federal Motor Carrier Safety Administration filing

- MCS90: Proof of access to a minimum amount of money to pay for injuries in the event of an accident

- BMC34: Cargo liability coverage

- OS/OW COI: Proof of sufficient liability insurance to operate oversize or overweight vehicles

- SR22: Demonstrates that drivers have filed minimum liability insurance with their state’s motor vehicles department

Every trucking business is unique. Where you travel and what you’re hauling will influence your filing requirements. While our team at American Insurance Brokers will check for compliance, it’s important that your insurance company is always keeping you up to date while you are enrolled in one of their policies.

4. Responsive customer service

Excellent customer service should be the standard, but it can be hard to find.

At American Insurance Brokers, we’ll ensure you’re on board with a company that is eager to assist. Whether it’s a quick question about your coverage or an immediate need, it should be easy to get in touch. Life on the road is unpredictable. After an accident or mishap, you need to speak with your insurer immediately.

From email and messaging to phone calls with a real person, customer service is a reflection of the company you partner with. You should feel at ease when you speak with them and reassured when you’re in a pinch.

5. Testimonials

When customers are happy, glowing reviews come naturally. For this reason, it’s important to closely analyze testimonials from truck insurance companies. This will help you determine the various strengths (and possible weaknesses) of an insurance provider.

Reviews are an important way to get an inside look at how credible a business is. It’s natural to trust your peers more than a sales pitch, so take some time to really read through any testimonials you can find.

See a negative experience somewhere? Pay close attention to how they address the situation and if there is a note about the issue being rectified. Don’t be afraid to ask the company about how they handle issues when in doubt.