The trucking industry is the backbone of a thriving economy. From the produce that ends up in your grocery store to the shoes for sale at a department store, trucks are used to transport all of these important products. What’s more, you’ll find nearly every variation of a commercial truck when you visit a construction site.

Because these vehicles are so vital, there are more and more of them taking to the road. This is where the importance of commercial truck insurance comes in. If you’re an independent driver or managing a fleet, it’s important to have a strong insurance policy backing your daily operations.

What Qualifies as A Commercial Truck?

A commercial vehicle is defined as any car or truck being used to transport passengers or goods for a profit.

On a small scale, transporting goods could mean moving them directly to individual customers across town. Alternatively, semi-trucks are used to move products across the state or even the country. These large commercial trucks often include trailers used to haul heavy loads, making them more complex and difficult to maneuver. Other commercial vehicles include cement trucks and similar vehicles used for construction.

Operating these types of vehicles is much different than driving an everyday car. For this reason, operators must have a special type of driver’s license, as well as Department of Transportation identification and other commercial markings. A commercial truck hauling hazardous material or particularly heavy loads will also require specialized accreditation and qualifications for operation.

What Is Commercial Truck Insurance?

Truck drivers and businesses using trucks require commercial trucking insurance. The most common types of individuals and companies that usually fall under this umbrella are motor carriers and owner-operators. Motor carriers are for-hire trucking companies that have an entire fleet of vehicles. Owner-operators are individuals operating their own businesses. Sometimes they own their truck, other times they lease it from a motor carrier.

Truck drivers and businesses using trucks require commercial trucking insurance. The most common types of individuals and companies that usually fall under this umbrella are motor carriers and owner-operators. Motor carriers are for-hire trucking companies that have an entire fleet of vehicles. Owner-operators are individuals operating their own businesses. Sometimes they own their truck, other times they lease it from a motor carrier.

As you begin to research commercial truck insurance, you may be wondering how it all works. As a policyholder, you will pay a monthly premium to retain your insurance policy. This allows you to have coverage in the event of an accident. This may include a crash, fire, theft, and many other scenarios. Your policy will include a range of different coverages to provide protection under any circumstance. If you find yourself involved in one of these situations, your deductible is the money you must pay before coverage kicks in. The policy limit is the maximum the insurer is required to pay towards a claim. Naturally, the team at American Insurance Brokers works to find policies with low deductibles and high limits.

The best policy for your business will depend on several factors. Your route, cargo, and level of risk will all be considered. The professionals at American Insurance Brokers will work with you to determine the coverages you need.

What types of vehicles does American Insurance Brokers cover?

From towing stranded drivers to hauling dirt from a construction site, there are a variety of situations that require commercial vehicles. At American Insurance Brokers, we search for full-scale coverage options that help you provide these important services.

Our portfolio of commercial vehicles includes, but is not limited to:

- Dump trucks

- Flatbed trucks

- Box trucks

- Tow trucks

- Tractor-trailers

- Moving trucks

- Straight trucks

- Tank trucks

- Cement trucks

If your truck isn’t on this list, don’t worry. Chances are, we can still find the commercial trucking insurance you need. Because we have decades of experience, we know there are unique complexities in the trucking industry. Get in touch with us to find out more about how we can serve you.

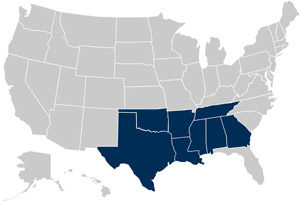

States served

While our roots are in Louisiana, we have expanded over the years to serve more states across the South. Because of our reputation, we’ve been the go-to for truckers in this region, which prompted our intentional expansion.

Our daily commutes are just like yours. We know there are unique traffic issues and severe weather events that impact daily life in the south. High winds, humidity, and hurricanes are the norm here. This is why we know exactly how to serve you. The states we cover include:

While federal insurance requirements are in place, state regulations will differ among these locations. The insurance specialists at American Insurance Brokers are well-versed in identifying the state-specific needs you have. Whether you’re confined to a state route or crossing borders, we can secure the coverage you need.

How Much Does Commercial Truck Insurance Cost?

According to a survey by Progressive, the national average monthly cost for commercial truck insurance is $640 for specialty truck drivers and $982 for transport truck drivers. That said, it’s important to remember that these are just approximations.

Your monthly premium will depend on several different factors, including:

- Vehicle type

- Driving record

- Geographic location

- Operating radius

- Cargo

- Contract requirements

- USDOT authority

The good news is, there’s no need to go searching for the best rates. At American Insurance Brokers, we have relationships with an entire network of highly-rated insurers. This gives us an edge and allows us to connect you with the most competitive coverage on the market.

Types of Commercial Truck Insurance

With so many different types of trucks on the road, it makes sense that there are many different types of coverage. Your policy will likely include several of the following types of insurance in order to provide you with the protection you need in a range of different situations.

Commercial auto liability insurance

Liability insurance provides blanket coverage for injuries or damage to other people or property if you’re at fault for an accident.

The bodily injury portion of your liability insurance may pay for hospital bills, long-term care, and much more. The property damage portion of your liability insurance may cover the cost of repairing or replacing damaged items, including other vehicles, equipment, and buildings.

This type of insurance may also cover legal defense costs if you are sued as a result of your involvement in an accident.

Physical damage insurance

A general term for a group of coverages that protect your vehicle. This usually includes collision insurance, as well as your choice of full comprehensive insurance or limited fire and theft with combined additional coverages.

Collision insurance covers the cost to repair or replace your vehicle if it collides with another object or overturns. Comprehensive insurance provides protection for your vehicle if it is damaged by something other than a collision with a vehicle or object. Fire and theft with combined additional coverage provides similar protection, but is limited to specific non-collision incidents.

Medical payments insurance

Also known as MedPay, this coverage kicks in to provide financial assistance for medical expenses if you and/or passengers in your vehicle are injured in a crash.

Uninsured motorist insurance

This is a type of insurance that protects you in the event of an accident with someone who does not have insurance (or does not have enough coverage to pay for your damages).eft, explosion or vandalism.

Trailer interchange insurance

Trailer interchange insurance provides physical damage insurance for trailers pulled under a trailer interchange agreement. This type of coverage protects you if the trailer is damaged by collision, fire, theft, explosion, or vandalism.

Non-trucking liability insurance

When you’re under permanent lease to a motor carrier (and you’re not driving under dispatch), non-trucking liability insurance provides coverage at an unlimited radius. This type of insurance may cover expenses for injuries or property damage.

Motor truck cargo insurance

Coverage for the cargo being hauled by a for-hire trucker. This may be due to cargo that is lost or damaged due to fire, collision, or striking of a load. You may also receive coverage for costs related to the defense or settlement of claims, as well as freight charges the customer loses because of not delivering a load.

Motor truck general liability

This general liability coverage is for injuries or property damage that arise as a result of business activities that are not directly related to operating your truck.

Examples include:

- A slip and fall on your property

- Incorrect delivery of products resulting in damage

- Actions of a driver while representing the insured at a loading dock or truck stop

- Libel and slander exposures

- Fire on a rental property due to insured’s error

On-hook towing insurance

There are certain risks associated with towing or hauling vehicles. On-hook towing insurance can pay to repair or replace a vehicle you don’t own if it is damaged by collision, fire, theft, explosion, or vandalism.

Garagekeepers legal liability insurance

Garagekeepers legal liability coverage is designed for businesses that offer towing services or operate service stations. This type of insurance provides protection in case a customer’s vehicle is damaged by fire, theft, vandalism, or collision.

Workers compensation insurance

A mandatory type of insurance required by businesses in many industries, workers comp covers medical costs and lost wages if an employee is injured on the job.

American Insurance Brokers: Your First Choice

Are you a fleet owner worried about protecting your drivers and trucks? Perhaps you’re a contractor in need of a single-truck policy to safeguard your livelihood? No matter the situation, American Insurance Brokers can help. We connect businesses of every size with commercial trucking insurance that is tailored to their needs.

Our free policy review is the best way to evaluate your current coverage. We will examine your policy for gaps and find ways to improve your coverage, as well as the premium you pay. The team at American Insurance Brokers can answer your questions, address any concerns you have, and provide you with a quote.

Contact us to get started today!

Truck drivers and businesses using trucks require commercial trucking insurance. The most common types of individuals and companies that usually fall under this umbrella are motor carriers and owner-operators. Motor carriers are for-hire trucking companies that have an entire fleet of vehicles. Owner-operators are individuals operating their own businesses. Sometimes they own their truck, other times they lease it from a motor carrier.

Truck drivers and businesses using trucks require commercial trucking insurance. The most common types of individuals and companies that usually fall under this umbrella are motor carriers and owner-operators. Motor carriers are for-hire trucking companies that have an entire fleet of vehicles. Owner-operators are individuals operating their own businesses. Sometimes they own their truck, other times they lease it from a motor carrier.