Commercial truck insurance is essential for trucking businesses. It provides important protection against the risks of operating large vehicles. Whether you’re an owner-operator or manage a fleet, having the right insurance coverage ensures that your business can withstand unexpected events and continue operating smoothly.

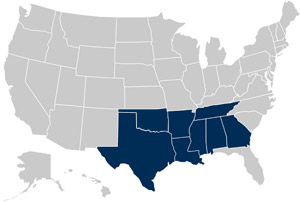

As a major hub in the Texas trucking industry, Houston presents unique challenges and opportunities. With its extensive network of highways and its role as a key port city, Houston is a vital center for freight and logistics. This makes it even more important for trucking businesses in the area to have robust insurance coverage to protect their assets and operations.

The purpose of this page is to provide comprehensive information about commercial truck insurance in Houston. Here, you can learn about different types of commercial truck insurance, its benefits, and how to get the right policy for you. Knowing these factors will help you make smart choices to protect your business and follow state and federal rules.

Do I Need Commercial Truck Insurance in Houston?

Legal Requirements in Houston and Texas

In Houston and across Texas, commercial truck insurance is not just a recommendation—it’s a legal requirement. Texas requires all commercial trucks to have liability insurance for injuries and damage to property. Key points include:

- Minimum Coverage: Most policies need to cover at least $750,000 in liability.

- Higher Limits for Hazardous Materials: Increased coverage requirements for certain hazardous materials.

- Regulatory Compliance: Ensures trucking companies are financially responsible for accidents.

Risks Involved in Trucking Without Insurance

Operating a commercial truck without insurance exposes businesses and drivers to significant risks:

- Financial Consequences: Medical expenses, repair costs, and legal fees can quickly add up, potentially leading to bankruptcy.

- Legal Penalties: Hefty fines, suspension of licenses, and potential bans on operation.

- Personal Liability: In the event of a serious accident, business owners may face personal liability, putting personal assets at risk.

Benefits of Having Commercial Truck Insurance

Commercial truck insurance offers numerous benefits beyond merely fulfilling legal requirements:

- Financial Protection: Covers costs associated with accidents, theft, and damage to vehicles and cargo, ensuring quick recovery from incidents.

- Enhanced Credibility: Demonstrates responsibility and preparedness, making clients and partners more likely to trust and engage with your business.

- Business Opportunities: Many contracts and freight agreements require proof of insurance, making it essential for securing new opportunities.

Commercial truck insurance is indispensable for trucking businesses in Houston. It ensures legal compliance, provides critical financial protection, and enhances business credibility, enabling you to operate confidently and sustainably in a competitive industry.

What Kind of Commercial Truck Insurance Can I Get in Houston?

Types of Insurance Policies Available

In Houston, a variety of commercial truck insurance policies are available to meet the diverse needs of trucking businesses. These policies are designed to provide comprehensive coverage tailored to different operational requirements and business models.

Owner-Operator Insurance

Owner-operator insurance is specifically designed for individuals who own and operate their own trucks. This type of insurance provides:

- Primary Liability Coverage: Protects against damages and injuries caused to others.

- Physical Damage Coverage: Covers repairs or replacement of your truck due to accidents, theft, or other perils.

- Non-Trucking Liability: Offers protection when the truck is being used for non-business purposes.

Motor Carrier Insurance

Motor carrier insurance is ideal for companies that own a fleet of trucks and employ drivers. This policy typically includes:

- General Liability: Covers bodily injury and property damage caused by business operations.

- Motor Truck Cargo Insurance: Protects the freight being transported.

- Workers’ Compensation: Provides coverage for employees in case of work-related injuries or illnesses.

Private Carrier Insurance

Private carrier insurance is suitable for businesses that use trucks to transport their own goods rather than for hire. Key coverages include:

- Liability Insurance: Protects against third-party claims for bodily injury and property damage.

- Physical Damage Insurance: Covers the costs of repairs or replacement of company-owned trucks.

- Cargo Insurance: Ensures the company’s goods are protected during transport.

Customizable Plans and Endorsements

A major benefit of commercial truck insurance in Houston is the ability to customize plans. You can add features to meet your specific needs:

- Trailer Interchange Insurance: Covers physical damage to a non-owned trailer in the insured’s possession.

- Hazardous Materials Endorsement: Provides additional coverage for trucks transporting hazardous materials.

- Gap Insurance: Covers the difference between the truck’s actual cash value and the remaining balance on a lease or loan.

Businesses in Houston can protect themselves by choosing the right commercial truck insurance. This will help them feel confident and secure while operating, as it covers a variety of risks.

What Commercial Vehicles Are Covered in Houston?

Houston commercial truck insurance protects different types of vehicles for businesses. It helps them secure their assets no matter what trucks they have.

The insurance covers a wide range of vehicles used by businesses. It ensures that businesses are protected financially in case of any accidents. Businesses can have peace of mind knowing their assets are covered with Houston commercial truck insurance.

- Semi-Trucks: These heavy-duty trucks are the backbone of the freight industry, hauling large loads across long distances. Insurance for semi-trucks typically includes liability, physical damage, and cargo coverage.

- Dump Trucks: Essential for construction and landscaping businesses, dump trucks require specialized insurance to cover their unique risks, including liability for materials being transported.

- Flatbed Trucks: Known for their versatility in hauling oversized loads, flatbed trucks need insurance that covers the wide range of cargo they transport, from construction materials to machinery.

- Box Trucks: Often used for local deliveries and moving services, box trucks are insured for both liability and cargo, protecting the goods they carry as well as covering potential accidents.

- Tow Trucks: These vehicles require comprehensive coverage that includes liability, physical damage, and on-hook coverage to protect the vehicles they tow.

Coverage for Specialized Vehicles

Insurance in Houston can cover different types of trucks, including specialized ones, in addition to the common ones. This includes:

- Refrigerated Trucks: Ensuring the protection of temperature-sensitive cargo.

- Tank Trucks: Providing coverage for trucks transporting liquids or gases.

- Hazardous Material Transporters: Offering specialized coverage for vehicles carrying dangerous goods.

Businesses in Houston can insure all their commercial vehicles with the proper insurance policy. This includes standard trucks and specialized haulers. The insurance policy helps to reduce risks while on the road.

How Does Commercial Truck Insurance Work in Houston?

Getting commercial truck insurance in Houston requires important steps to help you find the best coverage for your needs.

Getting Quotes

- Start by contacting multiple insurance providers to get quotes. This can typically be done online, over the phone, or through an insurance agent.

- Provide detailed information about your trucking operations, including the type and number of vehicles, the nature of your cargo, and your driving history.

Underwriting Process

- Once you’ve selected a quote, the insurance company will begin the underwriting process. This involves a thorough evaluation of the risks associated with insuring your business.

- The underwriter will assess your safety history, truck condition, age, and typical travel routes to calculate risk. They will consider factors such as your past safety record, the condition of your truck, how old it is, and where you usually drive. This information will help them determine the level of risk associated with insuring you.

- This process helps determine the final premium and coverage terms.

Policy Issuance

- After underwriting, the insurance policy is issued. You will receive documentation outlining your coverage, including the types of insurance, limits, deductibles, and any endorsements.

- Review this information carefully to make sure it fits your needs and that all details are correct.

How Claims Are Handled

If you need to file a claim, understanding the process can help ensure a smooth experience.

Filing a Claim

- In the event of an accident or loss, contact your insurance provider as soon as possible to report the claim.

- Provide all necessary information, including the details of the incident, the extent of the damage, and any involved parties.

Claim Investigation

- The insurance company will conduct an investigation to determine the validity of the claim.

- An adjuster will check the damage and collect information like police reports and witness statements.

Settlement Process

- After the investigation, the insurance company will decide the payment amount according to your policy terms.

- You will receive payment for damages or losses. You can use this money to repair or replace your truck. It can also help pay for medical bills or other related expenses.

By understanding these steps, trucking businesses in Houston can navigate the process of obtaining and using commercial truck insurance more effectively, ensuring they have the protection needed to operate with confidence.

The Benefits of Commercial Truck Insurance in Houston

Financial Protection and Peace of Mind

One of the primary benefits of commercial truck insurance is the financial protection it provides. Accidents, theft, and other unexpected events can result in significant financial losses. With comprehensive insurance coverage, you can ensure that repair costs, medical expenses, and other related costs are covered, preventing these incidents from severely impacting your business. This financial safety net allows you to focus on your operations with peace of mind, knowing that you are protected against unforeseen risks.

Compliance with State and Federal Regulations

Compliance with legal requirements is another crucial benefit of having commercial truck insurance. Both state and federal regulations mandate specific insurance coverage for commercial vehicles. In Texas, failing to meet these requirements can result in severe penalties, including fines, suspension of licenses, and the inability to operate. Having the appropriate insurance ensures that your business remains compliant with these regulations, avoiding legal complications and ensuring uninterrupted operations.

Coverage for Various Liabilities and Risks

Commercial truck insurance provides coverage for a wide range of liabilities and risks associated with trucking operations. This includes:

- Liability Coverage: Protects against claims for bodily injury and property damage caused by your trucks.

- Physical Damage Coverage: Covers repairs or replacement of your trucks in case of accidents, theft, or natural disasters.

- Cargo Insurance: Ensures the goods you are transporting are protected against damage or loss.

- Non-Trucking Liability: Offers protection when your truck is being used for non-business purposes.

This comprehensive coverage ensures that all aspects of your trucking business are protected, minimizing the financial impact of accidents and other incidents.

Support Services Offered by Insurance Providers

Many commercial truck insurance providers offer additional support services that can be invaluable for trucking businesses. These services often include:

- Roadside Assistance: Helps you get back on the road quickly in case of breakdowns, flat tires, or other roadside issues.

- Claims Handling: Streamlined and efficient claims processes to ensure quick resolution and payment.

- Risk Management Resources: Tools and advice to help you minimize risks and improve safety practices.

These support services not only enhance the overall value of your insurance policy but also contribute to smoother and more efficient business operations.

Secure Your Business with a Free Policy Review Today

Protect your trucking business today with comprehensive commercial truck insurance from American Insurance Brokers. Don’t wait until it’s too late—secure your peace of mind and ensure your operations are covered. Fill out the form for a free policy review and get a personalized quote tailored to your specific needs.

Our team of experts is ready to assist you in finding the best coverage for your business. Act now and drive with confidence!